One of the most important things to understand about operating a small business is that there is no “one size fits all” approach to what you’re doing. According to the US Small Business Administration, there are 28.8 million of these smaller organizations across the country – accounting for about 99.7% of all businesses in the United States. How many of them do you think have identical operating models to even that of their closest competitors? The answer is “not many,” which itself may be a bit on the conservative side, as every business is different. They’re all trying to do the same things, but they’re taking wildly different approaches to get there. Despite this, there is one factor that WILL affect all businesses to the point where many of them will fail to recover. According to a study that was recently conducted by US Bank, an incredible 82% of all businesses ultimately fail because of two little words: cash flow management.

Cash flow management problems are the worst kind of snowball effect. A small issue in visibility and oversight soon turns into a major one, stifling your growth and forcing you to turn down opportunities. Before you know it you’ve passed the point of no return and you’re wondering if your business will even be around this time next year at all.

Luckily, there is a better way. There are a few key cash flow management practices for businesses that can absolutely help you avoid the one essential mistake that could kill you.

Visibility is Key for Cash Flow Management

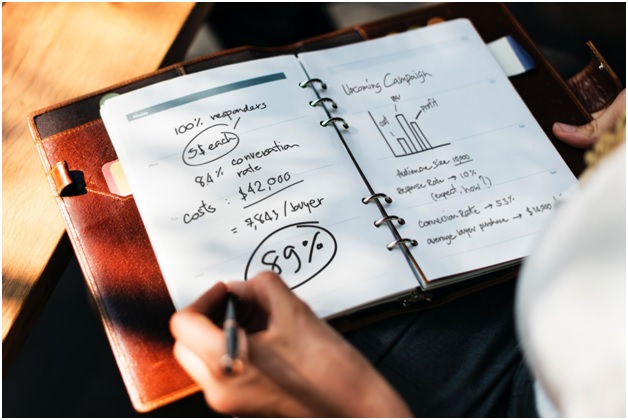

One of the most important steps that you can take today to help make sure you don’t run into cash flow problems tomorrow involves increasing your visibility as much as possible into your finances. It’s not enough to just now how much money you’re spending – you need oversight into expenses, revenue and most importantly the relationships between the two.

Bringing on a financial professional or even investing in a quality software solution won’t just let you know where you stand. It will help you identify trends and patterns based on historical financial data that let you make smarter, more informed decisions with your money moving forward.

Yes, you’re an entrepreneur. Part of the reason why you got this far was because of your “I can do it all” attitude. But that will only bring your business into life – it won’t actually let you become the success you’re hoping for. There are certain things that you’re going to need additional help for, and your finances are absolutely one of them.

Bring on a qualified CPA or other financial professional with actual, real-world experience in your industry as quickly as possible to help avoid this type of situation altogether.

Pay Attention to Trends for Proper Cash Flow Management

Another essential way to avoid the types of cash flow problems that can kill your business involves paying attention to both current “hot” trends and ones that are poised to become the next big thing. Making an effort to stay ahead of the curve is always a great way to maximize the impact of the materials you’re putting out into the world, which has many positive long-term ramifications in terms of things like cash flow and revenue.

Consider your marketing materials, for example. We know you have to spend money on marketing – this is not debatable. The kinds of materials you create, however, are ultimately up to you. However, these days visual content is big business and it’s absolutely where your attention should be focused.

You can create professional presentations, infographics and other types of visual collateral with a tool like PowerPoint or Visme. The great thing is that you don’t need design experience because these tools are built for people without years of graphic design educations under their belts.

This lets you create the perfect presentation or other piece of material that you need to connect with your marketplace, WITHOUT needing to hire a new staff member in order to do it. You get the same end result – a high quality piece of visual collateral – and you’ve saved a lot of money at the exact same time. You can then funnel those savings back into other areas of your business where they can do the most good.

Spend That Money Wisely

Another one of the most important cash flow management for businesses doesn’t necessarily have to do with looking for opportunities to spend less money, but to spend the right money in the right way at the right time.

Essentially, you need to actively focus on making sure that you’re spending your money in the right place and that what you’re getting out of a purchase justifies the existence of such an investment in the first place.

Take your business website, for example. A website isn’t something that you pay someone to design, wait for it to go live and the forget about. For many people, it will be the first point of contact they have with your brand. It’s supposed to be the best type of employee – the one that never eats, never sleeps and that is always working 24 hours a day, seven days a week.

Getting to this point isn’t going to happen overnight, though. You should use tools like this Website Grader to make sure that your site is actually designed in a way that allows it to function the way you need it to.

This, along with following best practices about what makes a good website, will help make sure that the return on investment for your website is where it needs to be so that you don’t run into cash flow issues down the road.

In the End…

Based on the available statistics, you would assume that cash flow management is so difficult that it’s no wonder most businesses fail because of this reason. But the truth is that it isn’t. It’s that problems due to passive cash flow management are so common they affect a huge number of organizations – the problems in and of themselves are not necessarily difficult to avoid once you know that they’re out there.

Always remember that cash flow management is an active process – it’s not good enough to just “create a system” and try to forget about it. Only by taking steps to generate superior visibility into your finances and by making sure that you’re spending your money in the right way will you be able to avoid these and other related traps for all time.